Trading in the financial markets can be an exciting and potentially lucrative venture, but it’s essential for beginners to approach it with caution and a solid understanding of the fundamentals. In the world of trading, having the right tools and strategies can make all the difference between success and failure. TradingView, a popular platform among traders, offers a wide range of indicators to help traders make informed decisions. Here are five key things every novice trader should know before diving into the world of trading.

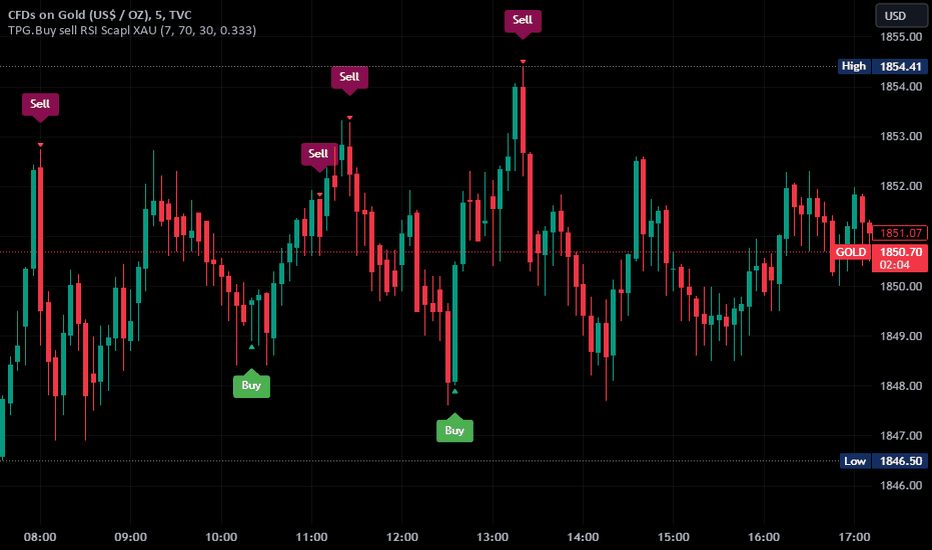

1. OmegaOptic Algo trading strategy:

OmegaOptic Algo is a powerful indicator designed to identify high-probability trading opportunities. This indicator utilizes advanced algorithms to analyze market trends and predict price movements with precision. By incorporating OmegaOptic Algo into your trading strategy, you can increase your chances of making profitable trades. Here’s how to use it effectively:

– Understand the key features and functionalities of OmegaOptic Algo.

– Implement the indicator in your trading platform and customize the settings to suit your preferences.

– Use OmegaOptic Algo signals to identify entry and exit points for your trades.

– Backtest your trading strategy using historical data to validate its effectiveness.

– Continuously monitor and adjust your strategy based on market conditions and new signals generated by OmegaOptic Algo.

2. TrendMaster Pro+:

TrendMaster Pro+ is another popular indicator among traders, known for its ability to identify trends and reversals accurately. By using TrendMaster Pro+ in your trading strategy, you can capitalize on market trends and maximize your profits. Here’s how to leverage this indicator effectively:

– Familiarize yourself with the features and functionalities of TrendMaster Pro+.

– Use TrendMaster Pro+ signals to identify the direction of the trend and potential reversal points.

– Combine TrendMaster Pro+ with other indicators to confirm trade signals and minimize false signals.

– Implement risk management techniques to protect your capital and minimize losses.

– Regularly review your trading strategy and make adjustments based on changing market conditions.

3. Alpawave Algo

Alpawave Algo is based on the Alpawave theory, which seeks to identify market patterns and predict future price movements. This indicator can be a valuable tool for traders looking to capitalize on market trends and fluctuations. Here’s how to use Alpawave Algo effectively:

– Learn about the Alpawave theory and how it’s applied in trading.

– Use Alpawave Algo signals to identify potential trade opportunities and confirm market trends.

– Combine Alpawave Algo with other technical indicators to enhance your trading strategy.

– Practice patience and discipline when trading with Alpawave Algo, as it may require waiting for the right signals to enter or exit a trade.

– Continuously monitor market conditions and adjust your strategy accordingly to maximize profitability.

4. UTbot Alert

UTbot Alert is a versatile indicator designed to alert traders to potential trading opportunities in real-time. By using UTbot Alert in your trading strategy, you can stay ahead of the market and make informed decisions. Here’s how to integrate UTbot Alert into your trading strategy effectively:

– Understand the algorithm behind UTbot Alert and how it generates trading signals.

– Use UTbot Alert signals to identify entry and exit points for your trades.

– Combine UTbot Alert with other indicators to confirm trade signals and increase their reliability.

– Practice good risk management techniques to protect your capital and minimize losses.

– Continuously evaluate the performance of UTbot Alert and make adjustments to your strategy as needed.

5. Moving AVerage

-

- Moving averages are one of the most popular technical indicators used by traders to analyze price trends over a specific period of time. TradingView, a widely-used charting platform, offers various types of moving averages to help traders make informed decisions.

-

- Moving averages help smooth out price data to identify trends easily. They act as dynamic support and resistance levels, providing valuable insights into the market direction. Additionally, moving averages can be used to generate buy or sell signals, helping traders navigate volatile markets.

-

- TradingView offers different types of moving averages, including simple moving average (SMA), exponential moving average (EMA), and weighted moving average (WMA). Each type has its unique characteristics and is suitable for specific trading strategies.

-

- To add a moving average on the TradingView platform, locate the “Indicators” tab, search for “Moving Average,” and add it to your chart. This tool allows you to customize parameters based on your trading preferences.

-

- Customize your moving average by selecting the type (SMA, EMA, WMA), period (e.g., 20, 50, 200), and color on the TradingView platform. Experiment with different settings to find the combination that works best for your trading style.

-

- Choose the appropriate timeframe for your moving average based on your trading goals. Shorter timeframes like 15-minute or 1-hour charts are ideal for day traders, while longer timeframes like daily or weekly charts suit swing traders and investors.

Using Moving Average for Trend Identification

Identifying Bullish and Bearish Trends with Moving Average

-

- By analyzing the relationship between price and moving average, traders can identify bullish trends (price above moving average) and bearish trends (price below moving average) on TradingView. This information helps in making informed trading decisions.

Using Moving Average Crossovers for Entry and Exit Points

-

- Moving average crossovers occur when short-term and long-term moving averages intersect, signaling potential trend reversals. Traders can use these crossovers as entry and exit points, enhancing their trading strategy.

Avoiding False Signals and Whipsaws

-

- While moving averages are reliable indicators, they can generate false signals during periods of low volatility. Traders should combine moving averages with other technical analysis tools to confirm trend signals and avoid whipsaws.

In conclusion, mastering the use of TradingView moving averages can significantly improve your trading performance. Experiment with different settings, analyze trends effectively, and refine your strategy over time to capitalize on market opportunities with confidence.