Mastering Moving Averages: A Comprehensive Guide to Successful Trading

Moving averages are foundational tools used by traders to analyze price trends over specific periods. They smooth out price data, making it easier to identify trend direction and potential reversals.

Importance of Moving Averages in Trading:

In technical analysis, moving averages play a pivotal role, aiding traders in making informed decisions about entering or exiting trades. They provide insights into market sentiment and act as dynamic support and resistance levels.

Brief Overview of Common Types of Moving Averages:

The three main types of moving averages—Simple Moving Average (SMA), Exponential Moving Average (EMA), and Dual Moving Averages—each possess unique strengths and are integral components of various trading strategies.

Basic Strategies for Trading with Moving Averages

A. Simple Moving Average Strategy:

- How to Calculate Simple Moving Averages:

- Simple Moving Averages (SMA) are computed by summing up closing prices over a specified number of periods and dividing by the number of periods.

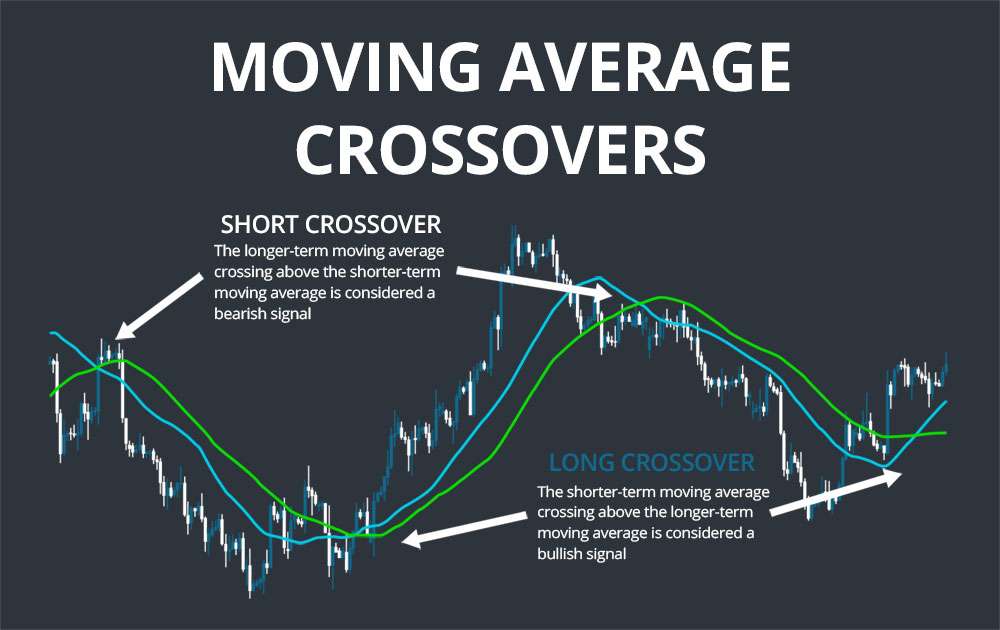

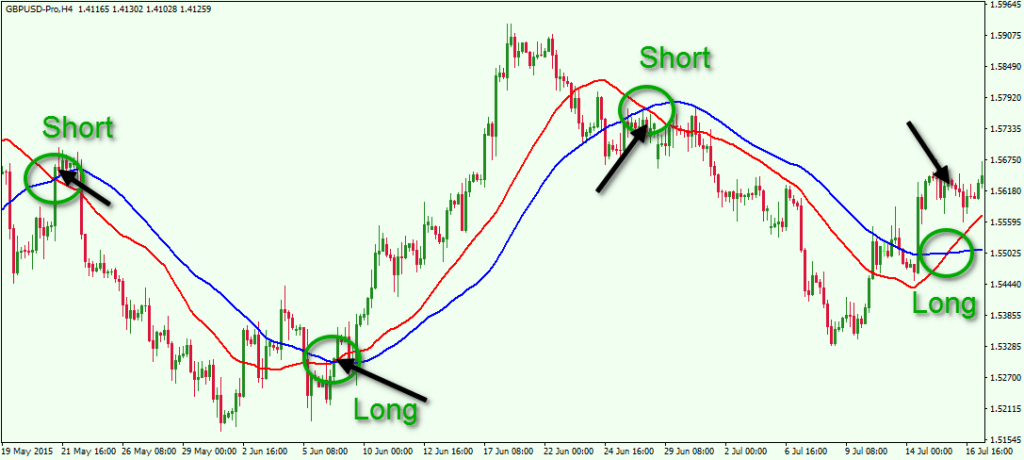

- Using SMA Crossovers for Buy and Sell Signals:

- A bullish signal is generated when a shorter-term SMA crosses above a longer-term SMA, indicating an uptrend. Conversely, a bearish signal occurs when the shorter-term SMA crosses below the longer-term SMA, signaling a downtrend.

- Setting Up Stop-Loss and Take-Profit Levels with SMA:

- SMA levels serve as dynamic support and resistance, aiding traders in establishing stop-loss and take-profit orders to manage risk and optimize profits.

B. Exponential Moving Average Strategy:

- Difference between EMA and SMA:

- Exponential Moving Averages (EMA) assign more weight to recent price data, enabling quicker responsiveness to current market conditions compared to SMAs.

- Identifying Trend Reversals with EMA:

- EMAs excel in detecting trend reversals early due to their swift reaction to price changes, offering traders timely insights into potential market shifts.

- Managing Risk with EMA for More Profits:

- Through closely tracking price movements, traders can leverage EMAs to identify precise entry and exit points, potentially maximizing profits.

C. Dual Moving Average Strategy:

- Combining SMA and EMA for Enhanced Signal Accuracy:

- Dual Moving Averages amalgamate different moving average types to filter out false signals, enhancing overall signal accuracy.

- Implementing Dual Moving Averages for Swing Trading:

- Traders frequently employ Dual Moving Averages in swing trading strategies to capture short to medium-term trends effectively.

- Adapting Dual Moving Averages for Different Timeframes:

- By adjusting the parameters of Dual Moving Averages, traders can tailor their strategies to suit various timeframes, ensuring flexibility in trading approaches.

Advanced Trading Strategies with Moving Averages

A. Moving Average Convergence Divergence (MACD) Strategy:

- Explaining MACD Indicator Components:

- MACD comprises three components—the MACD line, the signal line, and the MACD histogram—utilized for trend analysis and identifying potential buy or sell signals.

- Utilizing MACD Signal Line Crossovers for Trading:

- Signal line crossovers, where the MACD line intersects the signal line, often signal entry or exit points for traders, providing insights into market momentum.

- Maximizing Profit Potential with MACD Histogram Analysis:

- Analysis of the MACD histogram aids traders in gauging momentum shifts and potential trend reversals, enabling precise trade executions.

B. Bollinger Bands and Moving Averages Strategy:

- Understanding Bollinger Bands in Conjunction with Moving Averages:

- Bollinger Bands, paired with moving averages, offer valuable insights into market volatility and potential trading opportunities.

- Using Bollinger Bands to Confirm Moving Average Signals:

- Bollinger Bands validate signals generated by moving averages, particularly when prices approach upper or lower bands, indicating overbought or oversold conditions.

- Fine-tuning Entry and Exit Points with Bollinger Bands:

- Traders refine entry and exit points using Bollinger Bands, optimizing trade execution and risk management.

C. Moving Average Ribbon Strategy:

- Constructing Multiple Moving Averages on the Chart:

- Moving Average Ribbons, composed of multiple moving averages, provide visual cues regarding trend strength and direction.

- Interpreting Moving Average Ribbons for Trend Confirmation:

- Analysis of Moving Average Ribbons aids traders in confirming trends and identifying potential reversals, facilitating well-timed trades.

- Leveraging Moving Average Ribbons for Scalping and Day Trading:

- Moving Average Ribbons are particularly beneficial for scalping and day trading strategies, offering clear signals and aiding traders in staying aligned with prevailing trends.

Implementing Risk Management and Trading Psychology

A. Setting Realistic Expectations and Goals:

- Importance of Discipline and Patience in Trading:

- Discipline and patience are paramount for maintaining consistency and emotional resilience in trading, fostering long-term success.

- Avoiding Emotional Trading Decisions:

- Emotional discipline ensures rational decision-making, mitigating the impact of fear and greed on trading outcomes.

- Developing a Trading Plan Based on Moving Average Strategies:

- A well-crafted trading plan, anchored in moving average strategies, provides a roadmap for consistent and structured trading.

B. Risk Management Techniques with Moving Averages:

- Using Position Sizing and Stop-Loss Orders:

- Position sizing involves determining the appropriate amount of capital to allocate to each trade based on risk tolerance and account size. Stop-loss orders are then set at predetermined levels to limit potential losses if the trade moves against expectations. By adhering to proper position sizing and implementing stop-loss orders, traders can effectively manage risk and protect their trading capital.

- Diversifying Portfolio with Different Assets:

- Diversification is a key risk management strategy that involves spreading investments across various asset classes, markets, and instruments. By diversifying their portfolio, traders can reduce the impact of adverse price movements in any single asset or market, thus minimizing overall risk exposure. Moving averages can be applied across different assets to identify trends and potential trading opportunities, facilitating diversified trading strategies.

- Continuously Evaluating and Adjusting Trading Strategies:

- Markets are dynamic and subject to constant change. Therefore, it’s essential for traders to regularly assess the performance of their trading strategies and make necessary adjustments to adapt to evolving market conditions. By monitoring trade outcomes, analyzing market behavior, and refining their approach based on empirical data, traders can improve the effectiveness of their moving average strategies and enhance overall trading performance.

C. Staying Consistent and Adaptive in Changing Market Conditions:

- Being Flexible in Adapting Moving Average Strategies:

- While moving average strategies provide a structured framework for trading, it’s important for traders to remain flexible and adaptive in response to shifting market dynamics. This may involve adjusting parameters such as the length of moving averages, timeframes, or incorporating additional technical indicators to better align with current market conditions. By staying nimble and open to change, traders can optimize the effectiveness of their moving average strategies across various market envnments.

- Learning from Mistakes and Analyzing Trade Performance:

- Every trade presents an opportunity for learning and self-improvement. Traders should diligently review their trade history, identify any mistakes or weaknesses in their approach, and take proactive steps to address them. By conducting thorough post-trade analysis and embracing a growth mindset, traders can refine their skills, enhance decision-making abilities, and ultimately become more proficient in applying moving average strategies for trading success.

- Seeking Continuous Improvement with Ongoing Education and Practice:

- The journey to mastering moving average strategies is an ongoing process that requires dedication, perseverance, and a commitment to lifelong learning. Traders should actively seek out educational resources, attend workshops or seminars, and engage in simulated or live trading environments to hone their skills and deepen their understanding of market dynamics. By continuously seeking improvement and refining their craft, traders can stay ahead of the curve and achieve sustainable success in their trading endeavors.